This page is a useful guide to finding a home, whether you intend to buy or rent a house or other property in Jersey. Further information is also available to download in our Finding a Home brochure. Find more information on moving to Jersey in our Living and Working in Jersey or get in touch on +44(0)1534 440604 or locatejersey@gov.je

Finding Your Home in Jersey

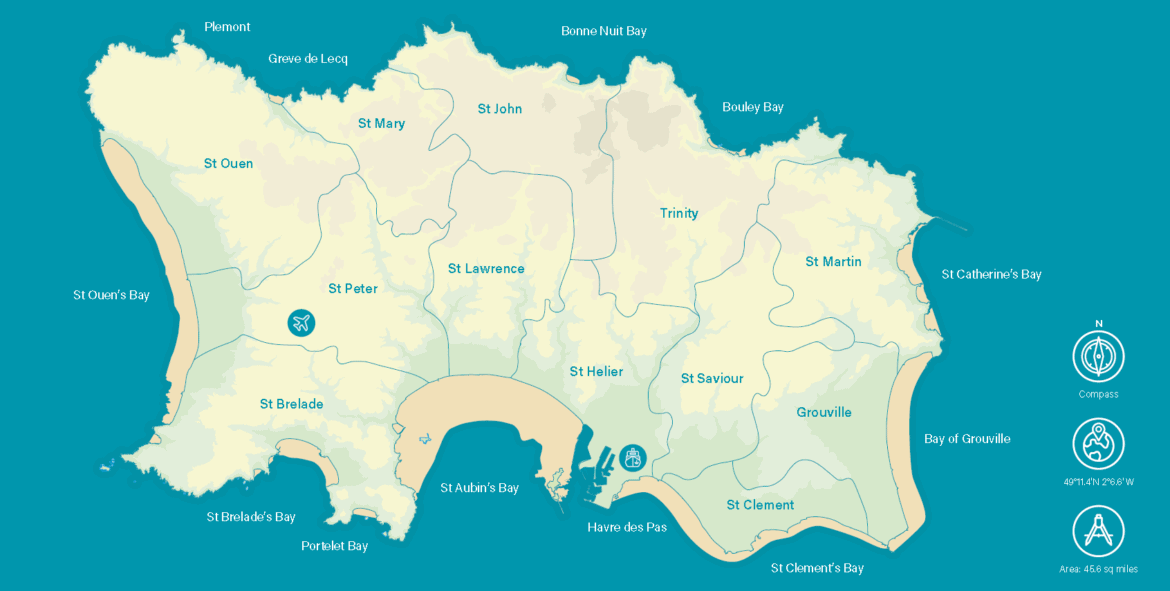

Buying a property in a new place when you have only just moved there is a big step. It is vital that you take the time to get to know the Island, the different parishes and the different types of property. Schooling is often a consideration for those with children. It is worth noting nursery places do not operate on a catchment area basis, however Jersey non-fee-paying schools do operate using catchment areas so this should be taken into account if this is a priority for you. You can find more information on schooling in Education in Jersey.

For many new arrivals, renting a property on the Island in the first instance is a better option before taking the next step and buying. This approach gives individuals and families a bit more time so they can make a better-informed decision. You can find out more about what it is like to live in the different parishes in our blog ‘Where to Live in Jersey’.

Jersey Residential Status

In Jersey, the right to buy and occupy residential property is controlled by law. Jersey residents fall into one of 4 categories (see below), with some restrictions placed on the property they can buy and occupy. For more information on residential qualifications please see our Residency and Immigration page.

- Entitled: someone who has lived in Jersey for 10 years or is a High Value Resident

- Licensed: someone who is employed by or who owns a trading Jersey business. A Licensed employee can buy, sell or lease any property, apart from first time buyer restricted or social rented housing, in their own name as their sole place of residence in Jersey so long as they keep their ‘licensed’ status

- Entitled for work: someone who has lived in Jersey for a continuous period of 5 years, or is married to, in a civil partnership with or is the eligible partner of someone who is Entitled, Licensed or Entitled for Work

- Registered: someone who does not qualify under the other categories.

Renting a Property

Anyone can rent property in Jersey but depending on your residential status you will be restricted to a certain category of housing. If you move to Jersey as a licenced individual with your business, or as a High Value Resident, you can rent any property on the Island, except social rented housing. There is also an expectation that High Value Residents who choose to rent, lease an apartment worth a minimum of £1.75 million and after 2 years purchase their own property.

The Island operates a Government approved tenancy deposit scheme called mydeposits Jersey. It is designed to protect both the tenant and landlord. The scheme ensures deposits are protected for the length of the tenancy and offers greater protection to the tenant in situations such as false claims, and death or insolvency of the landlord or agency. Landlords are also offered protection should the terms of tenancy not be met, or in the case of any damage or missing rent. It is a legal requirement to take part in the scheme and costs £21 which is taken from the deposit. Failure to use mydeposits will result in a fine of £10,000.

It is worth noting that the rental market in Jersey moves very quickly, so it is not uncommon for many properties not to make listing. It is therefore worthwhile having a good relationship with local estate agencies who may have un-advertised properties, so they can alert you immediately to new properties coming online that meet your requirements. You can find most local agencies through an internet search or using one of the local online property hub sites. It is also worth checking the Island’s daily newspaper (available online) and local social media groups for properties being let without the aid of an agency.

Buying a Property

The type of property can you purchase and/or occupy will vary according to your residential status.

High Value Residents

As a High Value Resident, with approved 2(1)(e) status, the Jersey Government will generally require that you buy or lease an appropriately valued property. Normally this is a property with a saleable value of more than £3.5 million (if a freehold house) or in the case of an apartment the saleable value is expected to be more than £1.75 million.

High Value Residents can also, subject to certain conditions:

- buy, develop and sell residential properties through a property development company. Any free-standing units of residential accommodation must be sold to Entitled or Licensed individuals on completion of the development

- can buy residential properties in their own name which have been unoccupied, or have been on the market for sale, for more than 2 years. These properties must be leased to Entitled or Licensed persons

- can buy a residential property that adjoins their main place of residence in Jersey if:

- the adjoining property more naturally falls within the same curtilage as the property already owned and occupied as their main residence

- it is approved by the Assistant Chief Minister.

It is expected that the purchase would be completed in the same name, either person or company, as their main residence. There may also be other conditions placed on the purchase.

(Please note that any income derived from Jersey property is taxed at 20%).

Licensed Individuals

Licensed individuals such as business principals relocating to the Island, can rent or buy any property, apart from first time buyer or social rented housing.

There are no expectations from the Population Office in regard to the value of the property, however licensed individuals are only allowed to own and occupy one property as their sole or principal place of residence.

It is also worth noting, should an individual lose their Licensed status and have not completed 10 years continuous residency they can no longer own, rent, or occupy a ‘qualified’ property. The individual would be expected to sell an owned property, or leave a rental property, unless they can find employment within another Licensed role within 3 months.

Registered Individuals

Registered individuals cannot purchase property in Jersey, they do not have access to the full rental market and are restricted to rental properties within the Registered housing category only. Once a Registered individual has completed 10 years continuous residency they become Entitled and can purchase or rent any property.

Entitled Residents

Can rent and purchase any property from the housing market.

Entitled For Work Residents

Entitled for Work only residents can buy property jointly with an Entitled or Licensed spouse or civil partner. They can also lease Registered property in their name as their main place of residence.

How to Buy a Property in Jersey

Buying a property in Jersey is slightly different to the UK. For example, all property transactions (except share transfer) are a public procedure and go before the Royal Court.

Jersey is probably one of the only global jurisdictions where you go to court to buy a property. The Royal Court passes property transactions on a Friday from 2.30pm. Purchasers (or their appointed agents) must attend, wear a tie, and stand up and raise their right hand when their property purchase is read out, and swear an oath that you are aware of the contents of the deed of sale and will not act against it upon pain of perjury.

Appointing a Lawyer

A Jersey qualified lawyer acting for the purchaser must present the contract to the Royal Court. There is no state guarantee of title in Jersey. It is the responsibility of the purchaser’s lawyer to correctly research the seller’s title to a property.

There are a variety of legal firms on the Island, and prices for conveyancing can vary but fees are generally more expensive than the UK. In Jersey, it is the legal firm acting for the buyer that effectively guarantees title.

Surveys

A lender will require a valuation survey of the property. In addition, the purchaser may require a report on the property to ensure there are no hidden defects, and the price offered is in accordance with market value.

There are several types of survey that can be provided by a chartered surveyor. It should be noted that from commission to completion, it can take two to three weeks to prepare a report, particularly a building survey.

Valuation

A valuation survey is normally carried out by a lending institution to provide ‘comfort’ regarding a property loan to purchase the property. It is based on a superficial inspection only of the property and presented on a simple template proforma. The surveyor will also take into account any apparent defects, the nature of the property, comparable evidence and material matters such as proposed planning developments in the near vicinity.

Homebuyer

A homebuyer’s survey and valuation report is sometimes termed an ‘intermediate’ report but is limited in respect of the value and nature of the property involved. It is suitable for smaller properties only.

Building

A building survey is an in-depth inspection of the property and associated buildings within the curtilage including boundary walls, paths and driveways.

A full report will be supplied and will normally contain photographs to amplify the contents of the report. If requested, an approximate estimate of the remedial work required can be obtained from a reputable building contractor specialising in maintenance and refurbishment.

Buying a Freehold Property

A freehold interest includes everything above and below a property within its boundaries for an unlimited period. The principle ‘he who owns the land owns everything reaching up to the very heavens and down to the depths of the earth’ generally applies. It is the common form of ownership for houses but does not apply to apartments.

Under Jersey law, a freehold property sale and contract lease (longer than nine years) is only binding once contract is passed before the Royal Court.

The process normally takes four to six weeks from acceptance of an offer to completion of a sale. Exchange of contracts and completion takes place on the same day, unlike the UK.

Flying Freehold

Flying freehold is frequently used for the sale of apartments. The Flying Freehold Law 1991 provides for the division of a property into private units and common units. Ownership of a private unit known as a ‘co-owner’ gives freehold title to an apartment and ancillary accommodation such as garden, parking space and store. Each co-owner is allocated a percentage interest in the common units such as entrance halls and stairways and is required to contribute towards their maintenance and upkeep.

The Contract of Purchase (a conveyance) sets out the description of the property, the rights and obligations of the co-owner. Each co-owner is a member of an Association of co-owners, which is responsible for the management and administration of the collective property. Associations levy a service charge (usually monthly or quarterly) to cover shared expenses such as insurance, cleaning, lighting and repairs.

A sale of a flying freehold unit is governed by the Housing Law and any purchaser must possess the relevant residential status.

Making an Offer

An offer can be verbal or in writing. The offer should be made ‘Subject to Contract’ and might also be conditional upon survey and title. You will also instruct lawyers to represent you in the purchase.

Preliminary Agreements

To provide security before contract completion or to take into account delayed completion, a preliminary contract can sometimes be agreed. Preliminary agreements are not commonly used in Jersey and will add to legal fees. The agreement will normally provide a penalty for failure to perform the contract. It is usual to provide a 10% deposit upon the signing of such an agreement.

Prior to completion of a preliminary agreement the purchaser’s lawyer will have made checks on title and recommended any conditions to be included in the agreement if there are issues or clarifications required.

Deed of Sale

The vendor’s lawyer will prepare the draft Deed of Sale, this is sent to the purchaser’s lawyer to check.

Searches

Your lawyer will make searches with the various bodies that may be able to provide information in respect of the property. Searches will include the parish authorities, utility companies and the Planning and Building Services Department.

Confirmation of Title

Your lawyer will research title by checking the Public Registry. The titles to the immediately neighbouring properties will also be looked at to ensure that the boundaries they claim towards the property to be purchased, and the rights set out in those properties’ deeds again correspond with the information set out in the draft Deed of Sale. This will include any rights of way or covenants held in relation to the property.

Mortgages and Lending Agreements

Any mortgage or lending agreement will attract stamp duty at a rate of 0.5% of the loan sum plus a registration fee of £80. Your lawyer should be advised of the arrangements in respect of any lending agreements. Your lawyer will also need to be provided with cleared funds for the property purchase before completion. Your lawyers will be under a legal obligation to pay over the monies on completion otherwise they are liable to be sued themselves.

Site Visit

On completion of searches, your lawyer will attend the site to ensure the draft deed of sale aligns with the situation on the ground. If any defects are found, your lawyer will report back to you, explain the difficulties and discuss whether or not the problem requires any remedial action to be taken. Resolution may require simple clarification but can involve approaching a neighbour to agree documentation to cover the problem encountered on site. An alternative approach is to obtain defective title insurance cover.

Written Inventory

The estate agent usually prepares an inventory of contents detailing any items of furniture, carpeting, etc. which are to remain in the property. This should be checked and countersigned by both parties.

Going to Court

In Jersey, freehold property transactions go before the Royal Court on a Friday afternoon. Conveyances are completed by passing a contract before the Royal Court whereby the parties swear an oath that they are aware of the contents of the deed and will not act against it on pain of perjury. Either you or your lawyer (authorised by a power of attorney) must be in attendance. If the purchaser or their authorised representative is not present, the property completion will not go ahead.

Possession of the Property

The estate agent usually negotiates the time for taking possession of the property after the Friday completion at court. It’s usual for the purchaser to be given the keys on passing of contract, but possession can take place immediately, or within three or four days.

Longer delays do occasionally occur but should be covered in the terms of the conveyance on your behalf by your lawyer.

Buyer Beware

Normally a purchase of a property will be on the basis it is acquired as found. On completion, the vendor is usually released from all and any responsibility for the property or its condition unless the parties have agreed otherwise.

Timescale

If all goes smoothly and there are no complications, most freehold property purchases take around 4 to 6 weeks. It’s a slightly quicker process than in the UK where property purchases take around 6 to 8 weeks.

Buying a Share Transfer Property

A freehold property may be owned by a Limited Liability Company. Shares in the company can be sold entitling the owners of those shares to exclusive use of certain parts of the company’s property (for example apartments within a building). The Memorandum and Articles of Association set out the rights and obligations of the individual shareholders of the company.

The advantage of a share transfer purchase is that the completion does not have to go before the Royal Court and therefore can be undertaken on any day of the week. The definition of “owner” for the purpose of a share transfer apartment is the holding company rather than the owner of the particular shares. It is not unusual to find that a high value property is owned by a Limited Liability Company for privacy.

Share transfer property purchases do not require the purchaser to have a registration card, but the intended occupier of the property will need to have a registration card in order to be able to prove their entitlement to occupy the property.

Broadly the process for the purchase of a share transfer property in regards of surveys, valuations and reports is similar to freehold properties.

Sale Agreement for Share Transfer

Because a share transfer transaction not only involves a property but also a company, additional checks are made to ensure that the company and its records are in order.

The vendor’s lawyer will prepare a draft agreement providing for the sale of the shares, including certain ‘warranties’ to be provided by the vendor, relating to the company and its property.

Memorandum and Articles of Association

The Memorandum and Articles of Association are the constitutional documents of a company and set out the rights and obligations of the individual shareholders in the company.

The Memorandum and Articles of Association should be in an acceptable format and correctly describe the apartment and any other areas (such as gardens, parking areas, garage, etc.) that are included within the sale. Some Articles of Association have uses which may be restricted such as owning pets and renting the property. This should be checked at an early stage to avoid any potential conflicts.

Company Records

Every company must keep records regarding shareholders, directors, secretary and decisions made by its shareholders and directors.

Company Title

A check will be made that the company has a good marketable title to the property, free of charges and ensure that the details in the company’s contract regarding boundaries and servitudes are correctly recorded.

Insurance

The main buildings and common parts will be insured by the company. Therefore, a shareholder only needs to insure the contents of the apartment including all internal wall, floor and ceiling finishes, kitchen and bathroom fittings and appliances, doors and windows and the decorative finishes. Insurance should be in place at the point of completion.

Survey and Valuation

A shareholder in the company will have a joint responsibility for the structure and exterior of the property as a whole. Accordingly, a survey will consider the condition of the whole building as well as the apartment being purchased.

Site Visit

Your lawyer will inspect the property to ensure that the company’s contract of purchase corresponds with the circumstances on site. If any defects are found these will be reported and options for any remedial action determined.

Completion of Share Vending Agreement

The share vending agreement is normally completed only when you are ready to take possession. If there is to be delayed completion, a preliminary agreement with deposit might be appropriate. Your lawyer must hold the purchase price balance in cleared funds on the day before a purchase completes.

Buyer Beware

Share transfer purchase agreements will ordinarily contain some warranties given by the vendor, primarily in connection with the affairs of the company rather than in respect of the property. These will usually be limited to matters which would not be identifiable from a review of publicly available documentation.

Co-ownership – Joint Ownership or Ownership in Common?

There are two forms of co-ownership recognised in Jersey law, joint ownership and ownership in common. The most important difference between types of co-ownership is what happens on the death of one of the owners.

Most married couples buy property as joint owners. On the death of a joint owner, their interest in the property passes to the surviving joint owner. On the death of one owner in common, their interest in the property passes on to their heirs.

Another key difference is in respect of the two ownerships’ ability to sell and/or alter a property interest. In the case of joint ownership consent is required from all the parties, while the contrary is the case in respect of an owner in common. Unless there is express wording in the contract stating that there is to be ‘joint ownership’, then the presumption in Jersey law is that co-ownership is by ‘ownership in common’.

Equity Agreements and Wills

A non-purchasing party may wish to have their economic interest in the property recognised by an ‘equity agreement’, recording the contributions to the property purchase and setting out what is to happen if the property is sold. This is particularly the case where a partner is unable to purchase under the Housing Law regulations.

Prospective purchasers should discuss the available options for any equity agreements and wills with their legal advisers to ensure that the arrangements put into place accommodate their wishes, taking into account any legal limitations.

Property Tax

Stamp Duty

Stamp duty is payable by the purchaser on all acquisitions or transfer of all freehold and flying freehold property. It is calculated on the market value of the property on a sliding scale up to a maximum rate as from 1st January 2020 of 10.5%* (for transactions above £6 million) and must be paid in full prior to the passing of contract.

Stamp duty of 0.5% plus a document fee of £80 is payable on any borrowing secured over Jersey real estate.

*This rate is subject to an annual review and may change. For the most up-to-date calculations, a ‘ready reckoner’ is available on the Government of Jersey website; www.gov.je/government/nonexeclegal/judicialgreffe/sections/publicregistry/pages/registryservices.aspx

Land Transactions Tax (LTT)

Land Transactions Tax is payable on share transfer property transactions and is broadly equivalent to the amount of stamp duty payable by someone buying a freehold property. Your lawyer will be able to advise you of stamp duty payable on the property and mortgage, if applicable.

Parish Rates

Jersey is divided into twelve parishes. Each parish levy rates which go towards parish expenses, repair and maintenance of parish by-roads and refuse collection for example. You must pay rates if you are an owner and/or occupier of ‘land’ (‘land’ includes any house, building, structure or land). If you own or occupy ‘land’ on the 1 January, then you’re liable for the rates for the whole year. An apportionment of rates is normally agreed between vendor and purchaser at the date of completion of sale.

Planning and Building Regulations

Planning Law in Jersey

Development of a property that includes change of use, demolition, new development, and alterations may require planning consent. If you’re planning to develop or alter your property, you should seek professional advice and ascertain the statutory requirements that may be in place. Planning permission deals with the use of land, the appearance of buildings, landscaping considerations, highway access and the impact that the development will have on the general environment.

Building Control

Building regulation approval is different from planning permission. Building control is concerned with the property structure. It has a different application and approval process. Building regulations deal mainly with health and safety matters. Regulations are in the interest of the people who will use the building and focus on how a building is constructed.

Building control consists of a two-stage process:

- The planning stage, when applicants submit detailed plans for approval.

- The inspection stage begins when work starts on site. A series of site visits are made by a building control surveyor as work progresses on site, to ensure the work is carried out in accordance with the various bye-law requirements.

Listed Buildings

It’s best to seek advice from the Historic Environment Team of the Government of Jersey or a qualified expert about whether permission is required for works to a listed building or structure.

Building Costs in Jersey

Building costs in Jersey are higher than in the UK in part due to the extra freight costs. The rates of tradesmen and builders in Jersey are also generally higher than the UK. A temporary business license is required to employ UK contractors in Jersey. This will only normally be granted if the service required is of a specialist nature and not normally available in the Island. For more information about temporary business licenses, please click here.

Useful Links and Contacts

- Government of Jersey: Renting or buying a property

- Government of Jersey: Planning and Building guide

- The Law Society of Jersey

- Jersey Estate Agents Association

- The Association of Jersey Architects

- Jersey Construction Council

- The Royal Institution of Chartered Surveyors

- The Jersey Water Company

- Jersey Electricity Company

- Jersey Gas Company

- JT Global (telecoms)

- Sure (telecoms)

- Airtel-Vodafone (telecoms)

- Jersey Post

- My Parish Online (Jersey Parishes)

- The Jersey Online Directory

For more information get in touch with a member of our team on

+44(0)1534 440604 or email locatejersey@gov.je

“We are thrilled with the beautiful, historical home that we found”

James Vernon